- Home

- Mindful Beauty Store

-

Mindful Beauty

- Natural Skincare

- Mindful Beauty - ArthroAroma

- Mindful Beauty Lavender Pillow Spray

- Mindful Beauty - Massage Oils

- Mindful Beauty - Serum 22

- Mindful Beauty - Serum 22 Organic

- Mindful Beauty Aromacology Bath Oils

- Mindful Beauty Natural Body Powders - Talc Free

- Mindful Beauty Exfoliator

- Natural Organic Foot Powder - Talc Free

- Tibetan Incense

- Aromatherapy Diffuser

- Professsional Salon Massage Oil 1 Litre

- Our Natural Cosmetics Ingredients >

-

Natural Beauty Tips Articles

>

- Beauty care - 7 beauty tips

- All About Facial Skin Care

- Celebrities Beauty Secrets

- Beauty Tips in Winter

- General Skincare Recommendations that May Help You Avoid Skin Problems

- Beauty Secrets Are All Around You

- Anti Aging Skin Care Guide?- Yes, Time To Glow Ladies

- The Best Skincare- 5 Mistakes You Can Avoid

- Skin Care Tips for Natural Glow

- Winter in the mountains: back to the season of dry skin?

- Bad Breath isn’t Good – How to Get Rid of It?

- Makeup artists not just for celebrities: how to choose one

- Natural Skincare For Acne Tips >

- Blog

- Contact Us

- Vitamins

- Mindfulness

- Wellbeing Articles

- GIfts, Books & Audio

- About Us

- Useful Herbal Remedies for Common Ailments

- Menopause Symptoms – Herbal Remedies

- Refund Policy

|

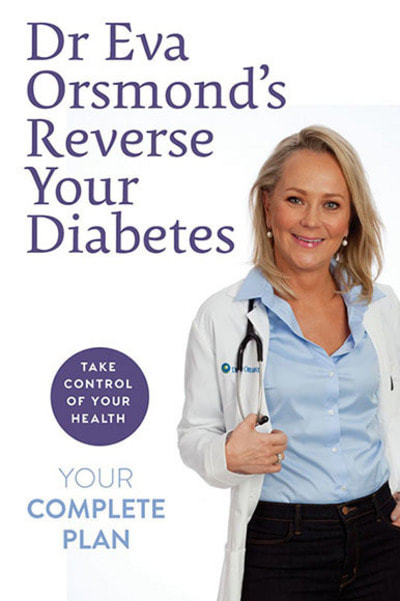

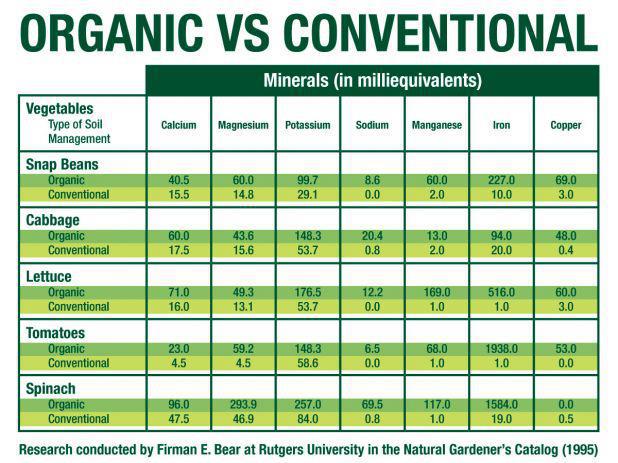

Did you know that your vitamins could go up by 23% when VAT is added in Ireland in the coming months? Not only vitamins but a lot of food supplements. Not only is this proposed addition on VAT not great for a consumer who has less and less money to be able to afford vitamins but also not good for the health store industry in Ireland. We have over 250 health stores up and down the country that also give fabulous dietary and health advice in their domain - natural health - to the seeking public. This government is not seeing that prevention is better than cure by their actions. The Irish government is planning to add VAT very, very soon unless you start to speak out and also write to your local T.D. In a theocracy when you speak out you get shamed but in a democracy you are exercising your right as a citizen to defend your rights and influence the way society should be structured around you rather than be imposed. Additionally for people and quangos not to act with impunity. Speaking out is an essential act as its how governments are shown policies are not popular to "we the people" and then they can adapt or drop t hem completely. For example, we have 60, 000 pregnancies each year in Ireland and all these Mum's will need vitamin B6 if they are to prevent against defects in the brain of the baby they are carrying. The vitamin also helps with morning sickness. So that will be 16 million Euros extra these new mothers will be paying over one year for this supplement. This in addition to antidepressants for 10,000 of the new mothers that each year develop post natal depression. The irony here is that people can have metaformin for free from this government but have to pay extra for supplements like chromium (glucose tolerance factor) that could help reduce the effects of onset diabetes. Dr Eva has said publicly that "type 2 diabetes lives in the belly fat" so if you have type 2 then you need to reduce your belly fat and change the diet to help the same. The result? You reverse type 2 and don't need diabetes drugs which will cost the tax payer millions. Your government incentivises you with Dr Eva as their ambassador to reverse this condition in the nation. This would be kind. Dr Eva is very compassionate with her 'tough love' of reversing this. Has anyone considered how tough the side effects of insulin dependence are which result from not reversing type 2 or early onset diabetes. Plus consider the pressure this is going to put on our public health system ? Our cousins in the USA are already saying they have a pre-diabetes epidemic with syndrome X or what is sometimes called 'metabolic syndrome'. The fact of the matter is that we do need supplements like vitamin D which at our latitude at the equator makes it essential for some people to take. We really need more sun. Additionally our foods from conventional farming which is full of pesticides no longer have mineral content. Plants take minerals from living top-soil which no longer exists in conventional agriculture. And yet every disease can be linked to some mineral deficiency: chromium to diabetes, selenium to cancer and zinc to immunity. These are just some of the connections. The government needs to not be making it harder for patients to get these supplements but easier. We are just about to be hit by another flu crisis which supplements like zinc and herbs like echinacea could help prevent in the first place freeing up our hospitals. St John's Worth which was banned a number of years ago is also a potent antiviral. Disease is the effect and not the cause. The Asian psyche by contrast, even governmentally, is prevention before cure. When the avian flu virus broke out some years ago government officials in China were buying traditional Chinese herbal medicine formulas to prevent contracting the disease. We have over 250 health stores in Ireland and many of them are Irish. Younger pharmacists are frequently going on to do post graduate training in herbal medicine, homeopathy, nutrition and to become naturopaths like our German medical cousins. They understand the critical connection with certain supplements and the prevention of disease. Recently James the CEO of Molly's pharmacy chain in Mayo had a man who he had helped with supplementation go on Midwest radio with him after he had surgery for his prostrate. Normally a person is in hospital for weeks after this and in nappies for six weeks. James had the man out of nappies post surgery with supplementation within three days. This is not the only story of how the natural health store movement and pharmacies can support people in the community. Also reducing the need for people to be in acute hospitals any longer than they need to be. Personally I feel that health stores in Ireland should not be faced with a VAT increase on products. Instead I think they should have a reduced rate of tax for the benefit they are giving to the public and the effort they are making toward disease prevention and should be given special rates and grants. Even more tax breaks if they have things like traditional bakeries attached making organic food and treatments rooms offering help from a range of qualified practitioners that, dare I say it, included qualified Dr's who may have gone on to train in healing modalities like acupuncture. If you don't want to be paying more for essential nutrients and herbs please sign this petition generated by the Irish Association of Health Stores to stop the hike. Share it to friends. The government needs to know how many people oppose this. This will also protect over 250 health stores in Ireland many of whom are indigenous and who offer great health advice to the public and are the backbone of the alternative routes to healing possibly curing some diseases. Even more so as the info gate to disease prevention. Here the link for the petition https://www.change.org/p/do-not-tax-health-food-supplements

1 Comment

|

AuthorBestselling author Ralph Quinlan Forde BSc (Hons) MA is the writer and editor of the Mindful Beauty blog. His first book The Book of Tibetan Medicine went into 11 languages. His second Nutriwine has Archives

February 2024

Categories

All

|

- Home

- Mindful Beauty Store

-

Mindful Beauty

- Natural Skincare

- Mindful Beauty - ArthroAroma

- Mindful Beauty Lavender Pillow Spray

- Mindful Beauty - Massage Oils

- Mindful Beauty - Serum 22

- Mindful Beauty - Serum 22 Organic

- Mindful Beauty Aromacology Bath Oils

- Mindful Beauty Natural Body Powders - Talc Free

- Mindful Beauty Exfoliator

- Natural Organic Foot Powder - Talc Free

- Tibetan Incense

- Aromatherapy Diffuser

- Professsional Salon Massage Oil 1 Litre

- Our Natural Cosmetics Ingredients >

-

Natural Beauty Tips Articles

>

- Beauty care - 7 beauty tips

- All About Facial Skin Care

- Celebrities Beauty Secrets

- Beauty Tips in Winter

- General Skincare Recommendations that May Help You Avoid Skin Problems

- Beauty Secrets Are All Around You

- Anti Aging Skin Care Guide?- Yes, Time To Glow Ladies

- The Best Skincare- 5 Mistakes You Can Avoid

- Skin Care Tips for Natural Glow

- Winter in the mountains: back to the season of dry skin?

- Bad Breath isn’t Good – How to Get Rid of It?

- Makeup artists not just for celebrities: how to choose one

- Natural Skincare For Acne Tips >

- Blog

- Contact Us

- Vitamins

- Mindfulness

- Wellbeing Articles

- GIfts, Books & Audio

- About Us

- Useful Herbal Remedies for Common Ailments

- Menopause Symptoms – Herbal Remedies

- Refund Policy

RSS Feed

RSS Feed